When you sell or buy products across borders, you deal with rules called Incoterms. These rules decide who pays for transport, customs, and duties. They also define who carries the risks at each step.

If you are an exporter or importer, you must understand these incoterms clearly. They affect cost, control, and the way your shipment moves. Two of the most common Incoterms are DDU and DDP. Many businesses confuse these two.

In this blog, we’ll clear the picture of DDP vs DDU in shipping for you.

What does DDP mean in shipping?

DDP stands for Delivered Duty Paid. This term puts maximum responsibility on the seller. If you are the seller, you cover almost everything until the goods reach the buyer’s place. It means you deliver goods to the buyer, and you pay for duties, taxes, and customs clearance. The buyer only receives the goods.

What Does DDU Mean in Shipping?

DDU stands for Delivered Duty Unpaid. This term shifts more responsibility to the buyer. If you are the seller, you only cover the delivery to the buyer’s country. The buyer handles duties and import clearance. It means you deliver goods to the buyer’s location, but you do not pay import duties or taxes.

Seller and Buyer obligations under DDP

The responsibilities of a seller and a buyer in DDP shipping are mentioned below briefly.

Seller obligations

- Arranges transport.

- Pays freight charges.

- Handles export and import clearance.

- Pays customs duties, VAT, or GST.

- Delivers goods to the buyer’s door.

Buyer obligations

- Accepts the goods.

- Pays for unloading in some cases.

- Provides import documents if required by local law.

Seller and Buyer obligations under DDU

In DDU, the buyer has more tasks to manage than the seller. The responsibilities of both are mentioned below.

Seller obligations

- Arranges transport.

- Pays for export clearance.

- Delivers goods up to the agreed location.

Buyer obligations

- Handle customs clearance in the destination country.

- Pay import duties, VAT, and other taxes.

- Take care of unloading costs.

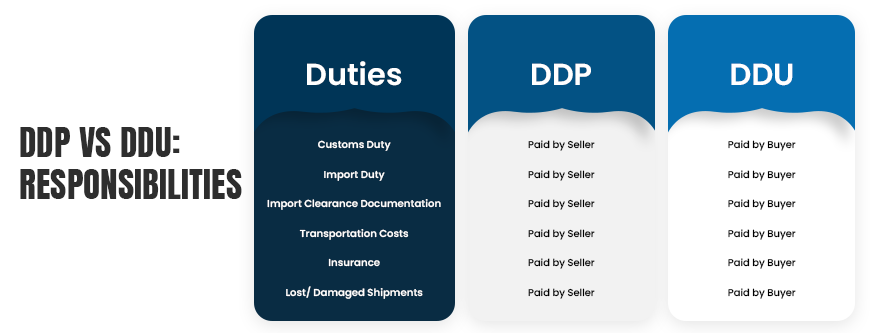

DDP vs DDU: Key Distinction

Both terms, DDU and DDP, define who pays what. The main difference is in import duties and customs. Here is a simple table to help you see the contrast:

| DDP (Delivered Duty Paid) | DDU (Delivered Duty Unpaid) |

| Custom duties are paid by the seller. | Custom duties are paid by the buyer. |

| Import taxes are paid by the seller. | Import taxes are paid by the buyer. |

| The seller handles risk of customs delays. | Risk of Customs delays is handled by the buyer in DDU. |

| The seller has more control in DDP than the buyer. | Here, the buyer has more control. |

Advantages of Delivered Duty Paid

The benefits of delivered duty paid (DDP) are mentioned below:

- Buyer enjoys smooth delivery.

- Seller builds trust with buyers.

- Suitable for new buyers who lack customs knowledge.

- Fewer chances of goods getting stuck at customs.

Advantages of Delivered Duty Unpaid

The benefits of delivered duty unpaid (DDU) are mentioned below:

- Buyer controls the import process.

- Buyer may pay lower duties if they know the local rules.

- Seller avoids dealing with foreign customs.

- Works well for buyers with import licenses and expertise.

Disadvantages of Delivered Duty Paid

In DDP, there are some drawbacks usually faced by the seller.

- Seller faces high costs.

- Seller risks penalties if they miscalculate duties.

- Complex for sellers shipping to many countries.

- Can lower profit margins for the seller.

Disadvantages of Delivered Duty Unpaid

The buyer has to face drawbacks when shipping under DDU. These disadvantages are mentioned below.

- Buyer may face delays if they are not ready with documents.

- Buyer pays duties separately, which may raise costs.

- Risk of disputes if the buyer feels charges are too high.

- Less convenient for buyers with no import experience.

DDP vs DDU: Risks involved

When shipping under DDP or DDU, there are some risks involved for sellers and buyers.

In DDP:

- Seller may misjudge duties.

- Customs laws may change suddenly.

- Delivery may take longer if documents are missing.

In DDU:

- Buyer may not prepare papers on time.

- Goods can get stuck at customs.

- Unexpected duties may upset the buyer’s budget.

Tips for E-commerce businesses using DDP and DDU

Managing DDP and DDU well helps e-commerce businesses avoid confusion, reduce delays, and ensure smooth international shipping experiences. Here are some tips for e-commerce businesses using DDP and DDU.

- Check the rules of the country you are shipping to.

- Decide early who pays for duties and taxes.

- For new customers, offer DDP to build trust.

- Always explain charges before shipping.

- Track your shipment and update the buyer.

Key Takeaways

- DDP full form is Delivered Duty Paid, where the seller covers almost all costs.

- DDU full form in shipping is Delivered Duty Unpaid, where the buyer pays import duties and taxes.

- Under Incoterm DDP, the seller manages export, import, and final delivery.

- Under DDU in shipping, the buyer takes care of import clearance and pays charges.

- Clear use of DDP and DDU avoids disputes and builds smoother trade relations.

Conclusion

DDP and DDU are two common Incoterms in global trade. Both decide how costs and risks are shared. In DDP, the seller pays for everything until delivery. In DDU, the buyer takes care of duties and customs. Each has its own pros and cons. The right choice depends on your business role and experience.

Some want goods at their doorstep without extra effort. Others prefer handling duties on their own. The best option between DDP and DDU is the one that matches your business model. At the end, clear terms mean smoother trade and stronger trust.

FAQs

What does DDU mean in shipping?

DDU in shipping means Delivered Duty Unpaid where the seller delivers goods, but the buyer pays duties and handles customs clearance.

What does DDP mean in shipping?

DDP means Delivered Duty Paid and here, the seller pays for freight, duties, and taxes until the goods reach the buyer.

What are the key differences in DDP vs DDU shipping?

The main difference is of duties. Under DDP, the seller pays duties and taxes. Under DDU shipping, the buyer pays them.